The Challenge

As a pioneering B2B fintech company in the fixed income space, Harmoney is driving innovation by digitizing traditionally manual workflows through a single-screen solution. Built for institutional investors, the platform improves efficiency and access in a sector steeped in legacy systems.

However, the brand faced two core challenges:

01

Awareness

Despite the strength of their product, they lacked broad awareness among high-influence decision-makers in capital markets.

02

Elevating brand perception

Existing perceptions didn’t reflect their differentiated value as a technology-first partner, requiring perception correction and elevated brand perception.

The objective was clear: elevate the brand’s visibility and shift industry perception to reflect their true positioning as an innovation leader in fixed income trading.

The Approach

After evaluating multiple go-to-market strategies, we recommended a flagship event as it enabled a targeted approach, the opportunity to establish one-on-one dialogue with industry leaders, and shape perception in the most effective way.

The closed-door format enabled precise targeting by inviting industry leaders to speak on digitization and earning industry validation without overt brand messaging. Framing the event around a pressing industry challenge positioned the brand as a facilitator of strategic dialogue, reinforcing its role in advancing digital workflows in fixed income.

The Solution

We played an end-to-end strategic and executional role—bringing the event to life not just as a marketing activity, but as a flagship brand asset designed for long-term equity.

1. Strategic conceptualization:

Starting from a whiteboard, our team developed the entire event identity.

-

Event Identity development:

We developed a distinctive key visual identity and event name to build brand recall and establish immediate recognition across touchpoints that reinforced the brand’s premium positioning throughout the event experience. -

Theme and narrative curation:

We developed a cohesive theme and narrative that positioned digitization as a critical industry shift, with the brand as a key enabler. -

Corporate video production:

Produced a high-impact corporate video that captured the brand’s story and vision, setting the tone for the event and reinforcing their innovation-first identity.

2. Digital & creative buildout:

To create pre-event momentum and lasting digital presence, we:

-

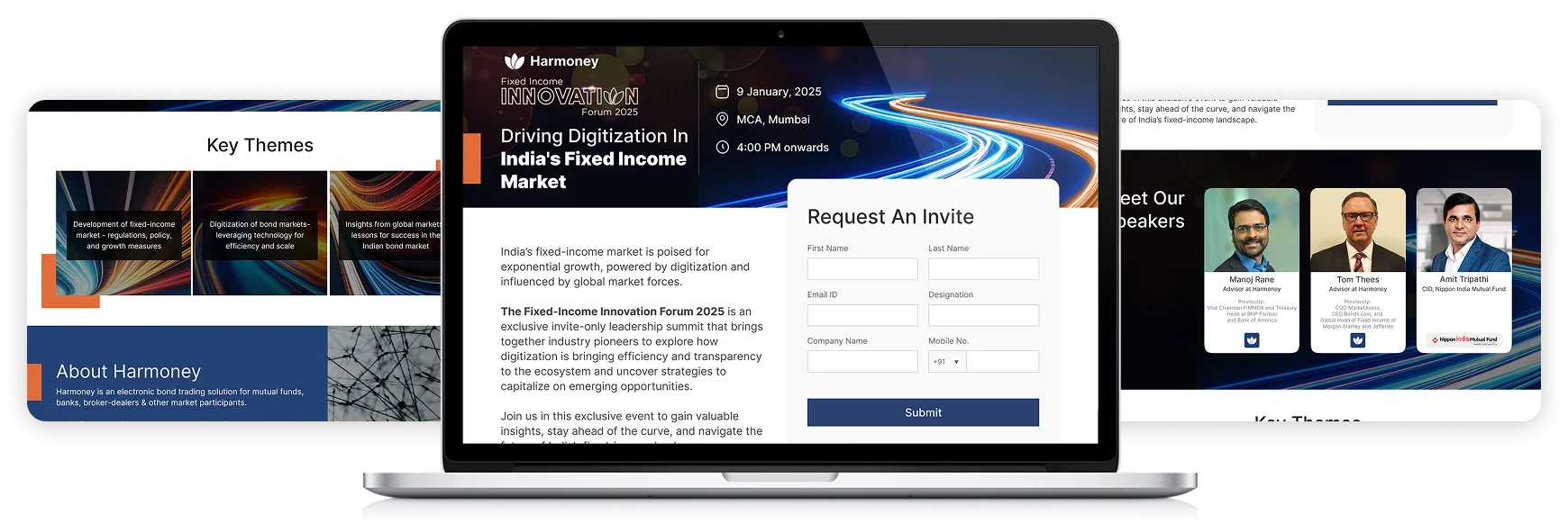

Microsite:

Developed a dedicated microsite to drive event engagement, house content, and serve as a digital home for the IP.

-

Integrated digital and on-ground branding assets:

Built a comprehensive content ecosystem—from online promotional visuals and content to on-ground collaterals—ensuring every touchpoint reflected a unified brand story.

-

Pre-event momentum strategy:

Our promotional campaigns were designed to build anticipation while pre-educating the audience on key digitization themes, positioning the client as the convener of critical industry dialogue before attendees even entered the room.

3. On-ground execution & post-event amplification:

Our team was embedded on the ground, ensuring seamless execution and post-event momentum. Additionally, the impact of the event extended well beyond the day itself, sparking ongoing conversations within the financial industry.

-

Extended on-ground support and management:

Managed end-to-end logistics and stakeholder coordination to ensure a seamless experience. -

Content capture for longevity:

We implemented a comprehensive content capture strategy designed to fuel six months of thought leadership content, including video bytes, speaker highlights, and snackable insights for ongoing narrative reinforcement across marketing channels.

This included

- Showcasing industry insights

- Event session highlights

- Advisor-led amplification

- Sustained conversations for over 6 months

Impact

The initiative successfully delivered on both core objectives: increasing brand awareness and reshaping market perception. By anchoring the event around a compelling industry theme and targeting the right decision-makers, we helped position the brand not just as a product provider—but as a credible voice shaping the future of fixed income trading.

Multi-channel marketing impact

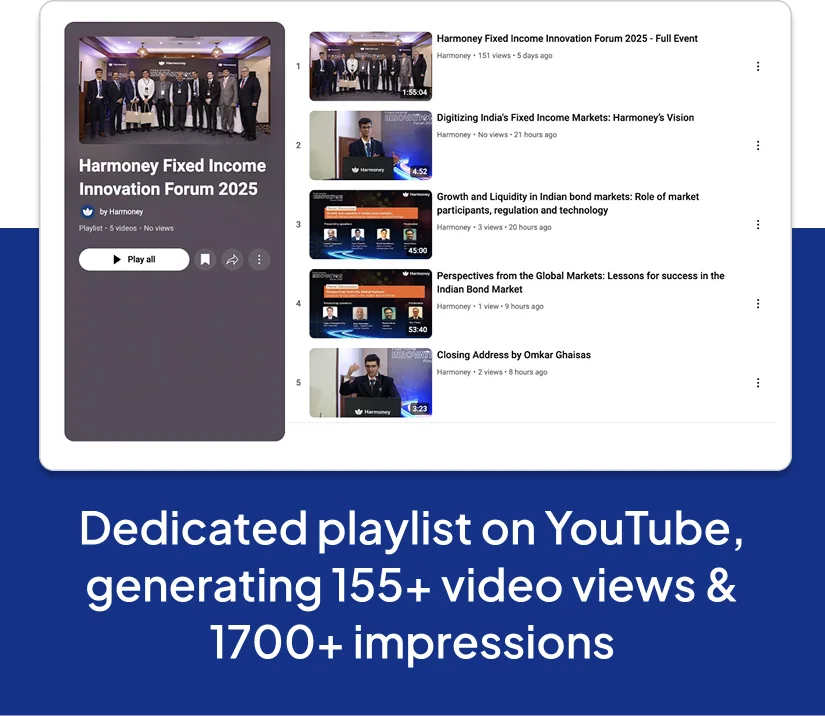

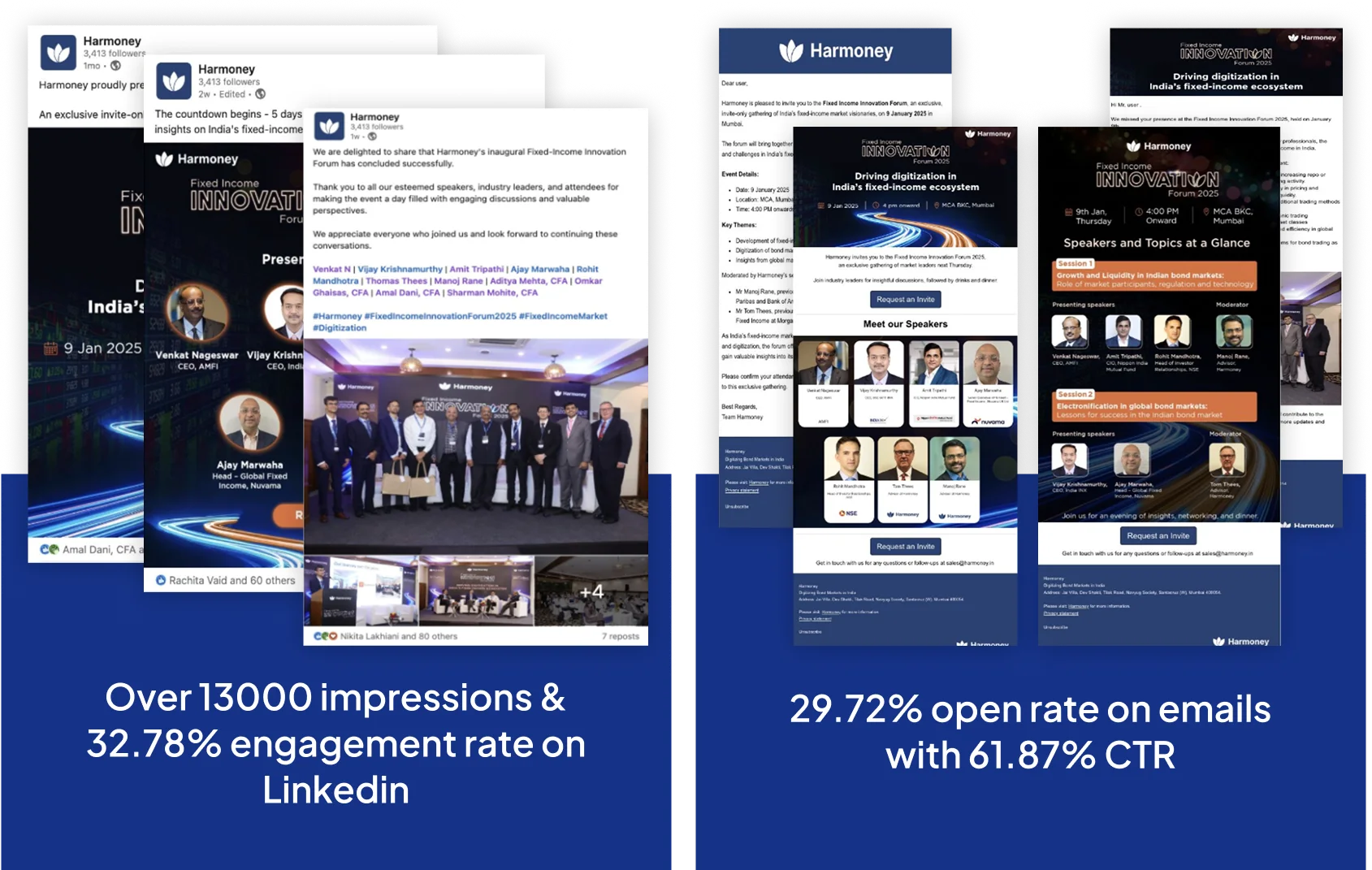

Our content engine surrounding the event drove strong engagement across platforms:

- LinkedIn drew over 13,000 impressions with a standout 32.78% engagement rate.

- Email campaigns outperformed with nearly 30% opens and 62% click-throughs.

- The event microsite saw 350+ visits, serving as both a content hub and a lasting digital footprint for the IP.

- YouTube content, including speaker clips and highlights, generated 1,700+ impressions—extending the event’s impact well beyond the room.

High-quality stakeholder acquisition

The event brought the right people into the room and the spotlight:

- We secured 7 high-caliber industry leaders as speakers and panelists—lending weight and credibility to the conversations.

- Attracted 50 senior delegates from across the ecosystem, including CXOs, VPs, Department Heads, and Senior Managers—ensuring high-impact engagement with the brand’s core ICP.

Events like these are fantastic because fixed income investing in India is pretty nascent. Anything to promote any pool of investment – to start looking at fixed income, start looking at how we can diversify our investments portfolio – is more than welcome

Ajay Marwaha, Nuvama

SPEAKER

It was a very good event and the stage at which the debt markets are at India, we are in the stage of evolution. The way Harmoney is going to be catalyst for this evolution is a good step for the future.

Ravi Thakkar, ICAP

DELEGATE

Event was fantastic. We had panels from the AMFI to the mutual fund to the wealth house as well. We look forward to certain types of events. I am expecting (to attend) the second event very soon.

Nikhil Agarwal, Nuvama

DELEGATE

This wasn’t just a successful event. It was a brand-defining moment—creating lasting equity, igniting valuable relationships, and firmly establishing the client as a leading voice in the digitization of fixed income market in India.